What is Market Order and Limit Order in crypto?

Unlock the essential strategies behind market orders and limit orders when trading cryptocurrencies. This guide provides the guidance you need to invest wisely and steer clear in crypto.

To buy and sell cryptocurrencies, exchanges platforms offer different types of orders. The two most common ones are market orders and limit orders. If you're just starting in crypto, it's important to understand these concepts to invest wisely or avoid making mistakes. This text will help you with that.

What's the difference between Limit Order and Market Order?

The main difference between a limit order and a market order is the price at which the order will be executed. A market order is executed immediately at the best available price in the market. This means you may not get the price you want because the order will be executed at the price someone else is willing to pay or sell.

On the other hand, a limit order is executed only at the price you specify. This means you may have to wait until the market price reaches your limit, which could take longer. However, it also means you have more control over the price at which you buy or sell your cryptocurrency.

Click here to understand how the crypto market works!

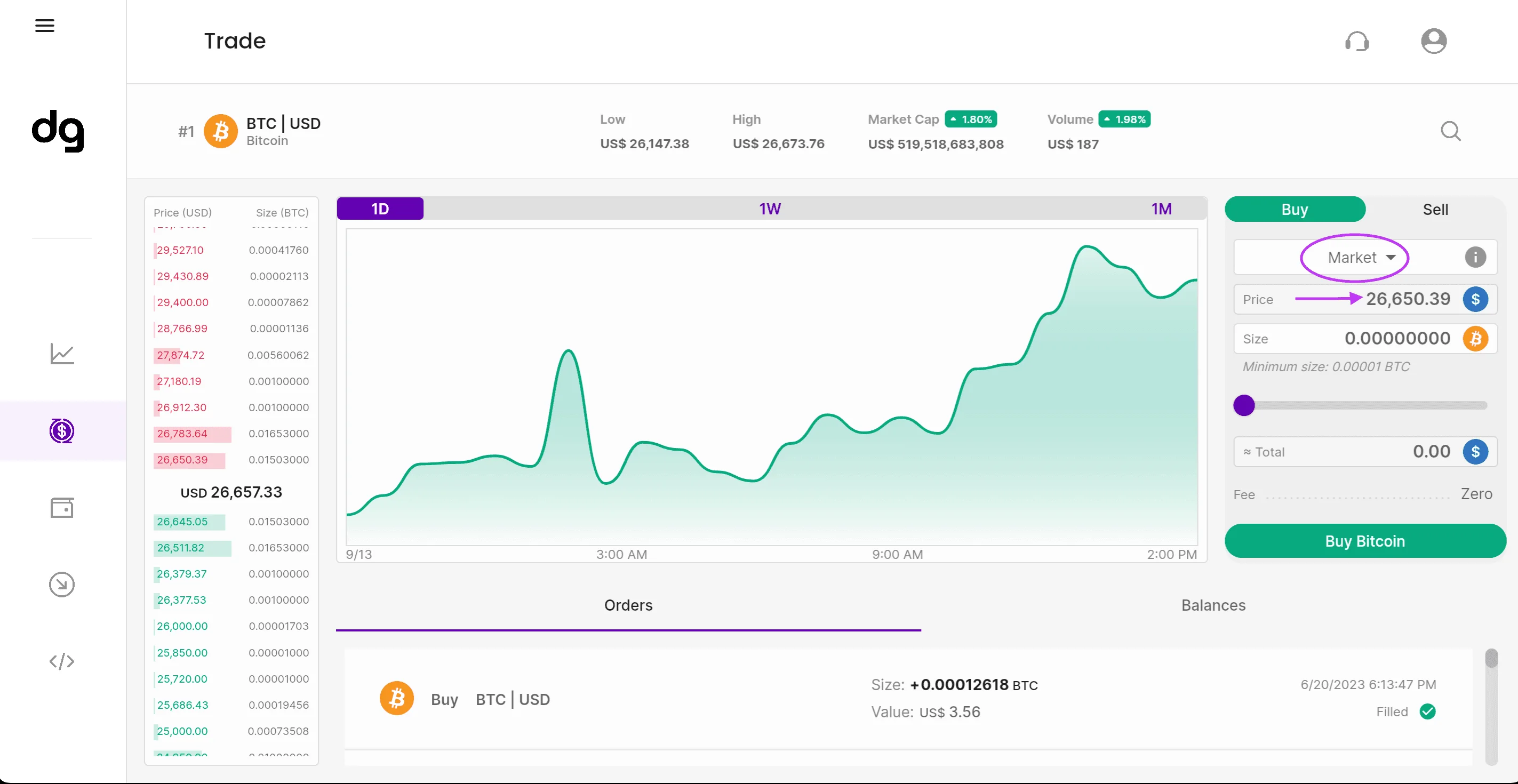

How does a Market Order work?

When you place a market order, you're essentially telling the market, "I'm ready to trade immediately at the best available price."

For example, let's say you want to buy 1 Bitcoin. The current price of Bitcoin is around $26,000 at the time of writing this text. If you place a market order, your order will be executed immediately at the best available price, which could be higher or lower than $26,000.

However, if the market is bullish, the price of Bitcoin could rise to $27,000 before your order is executed. In that case, you'll pay $27,000 for your Bitcoin, even if you wanted to pay $26,000. Keep in mind that we only used these values to make the example more understandable; however, with the speed of a market order, price variations of a thousand dollars are extremely rare. The variables' decimal differences are far more likely.

One good thing about market orders is that you can trade quickly if you don't want to waste time and want to take advantage of the current offer. On the downside, they usually come with higher fees, especially on leveraged exchanges like Binance and Bitmex.

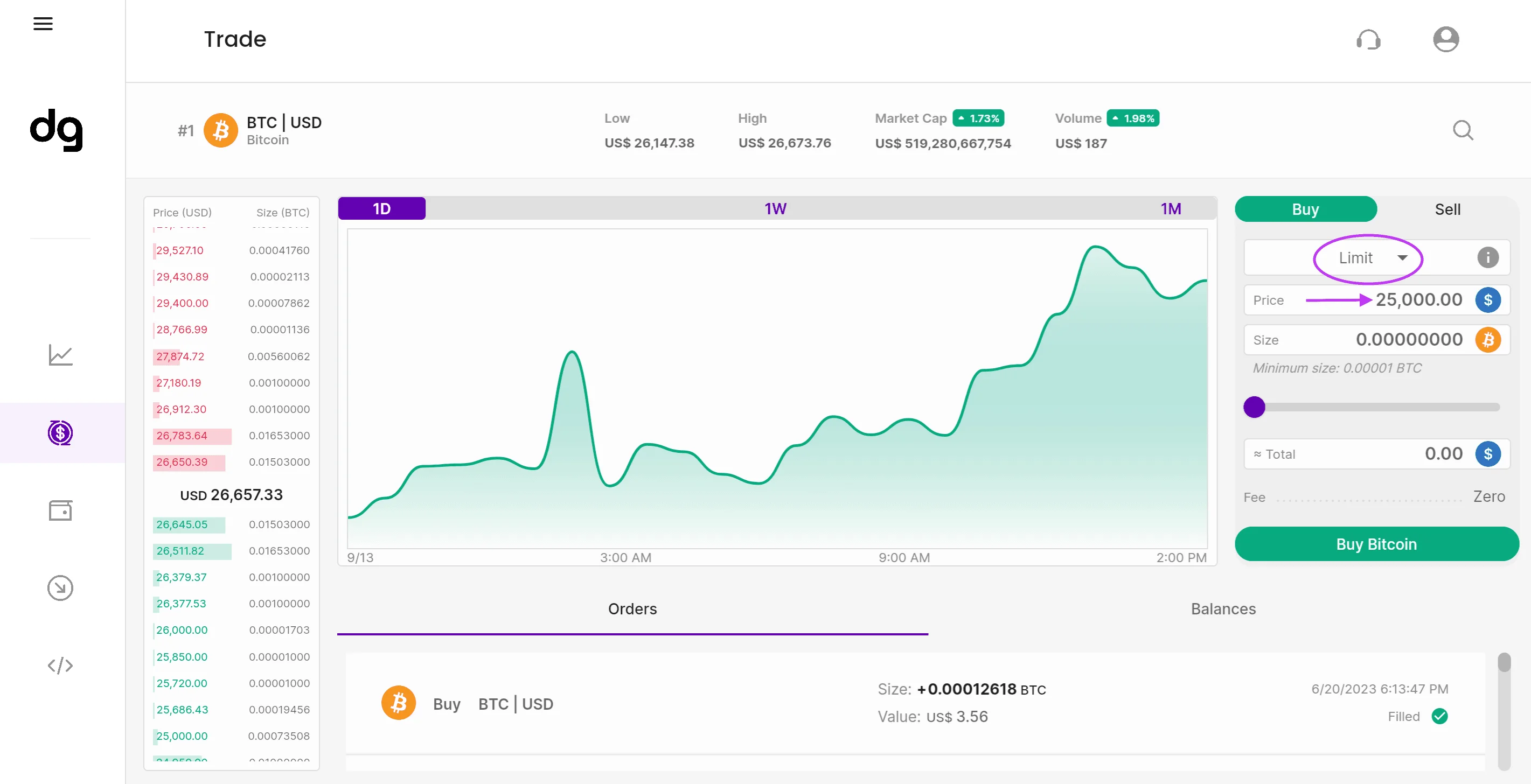

How does a Limit Order work?

When you place a limit order, you're essentially telling the market, "I'm ready to buy or sell at a specific price. Execute my order if the market reaches that price."

For example, let's say you want to buy 1 Bitcoin but are only willing to pay $25,000. If you place a limit order with a limit price of $25,000, your order will only be executed if the Bitcoin price drops to $25,000 or lower. If the price doesn't reach $25,000, your order won't be executed.

With this type of order, you have more control over the price you want to trade, but it may take much longer to fully execute. If you want your order to be executed on the same day and are in a hurry for the trade, we suggest opting for a market order.

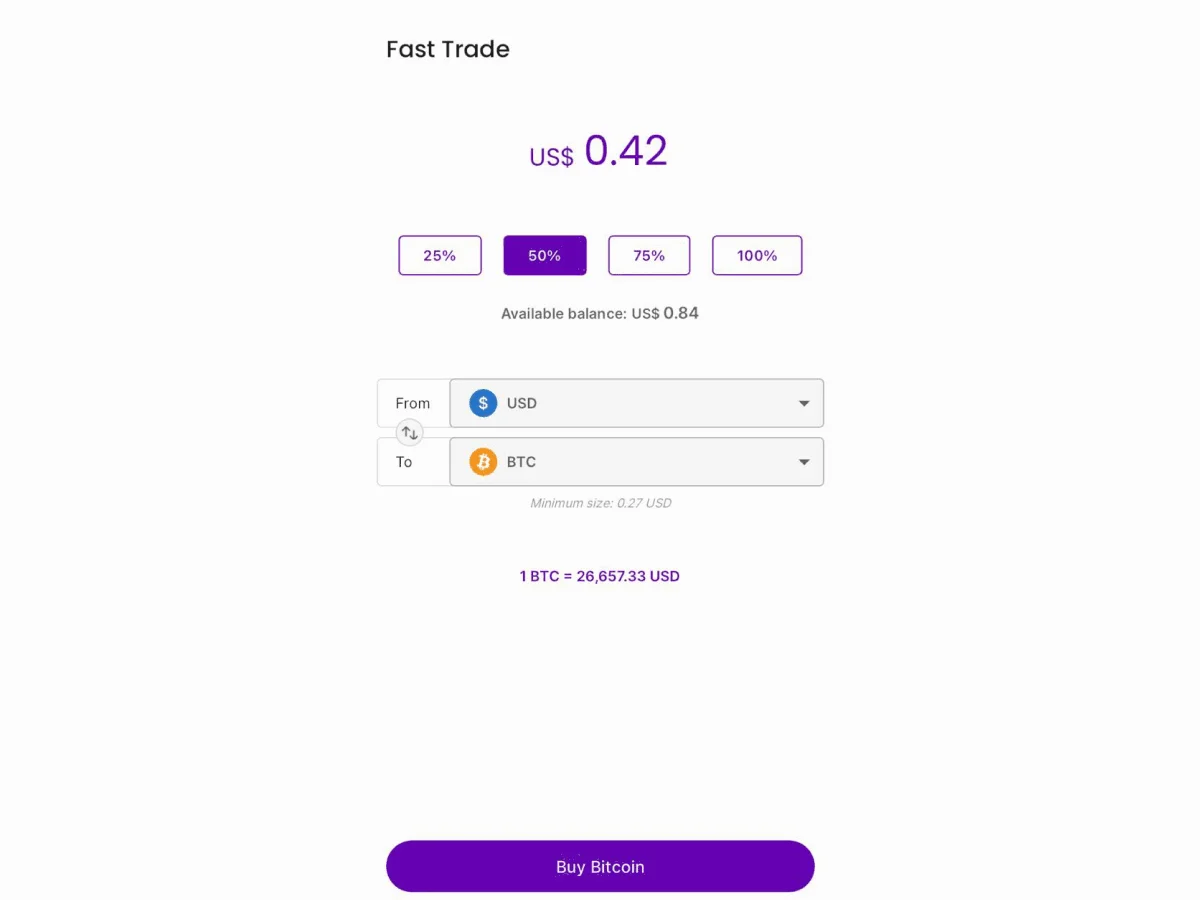

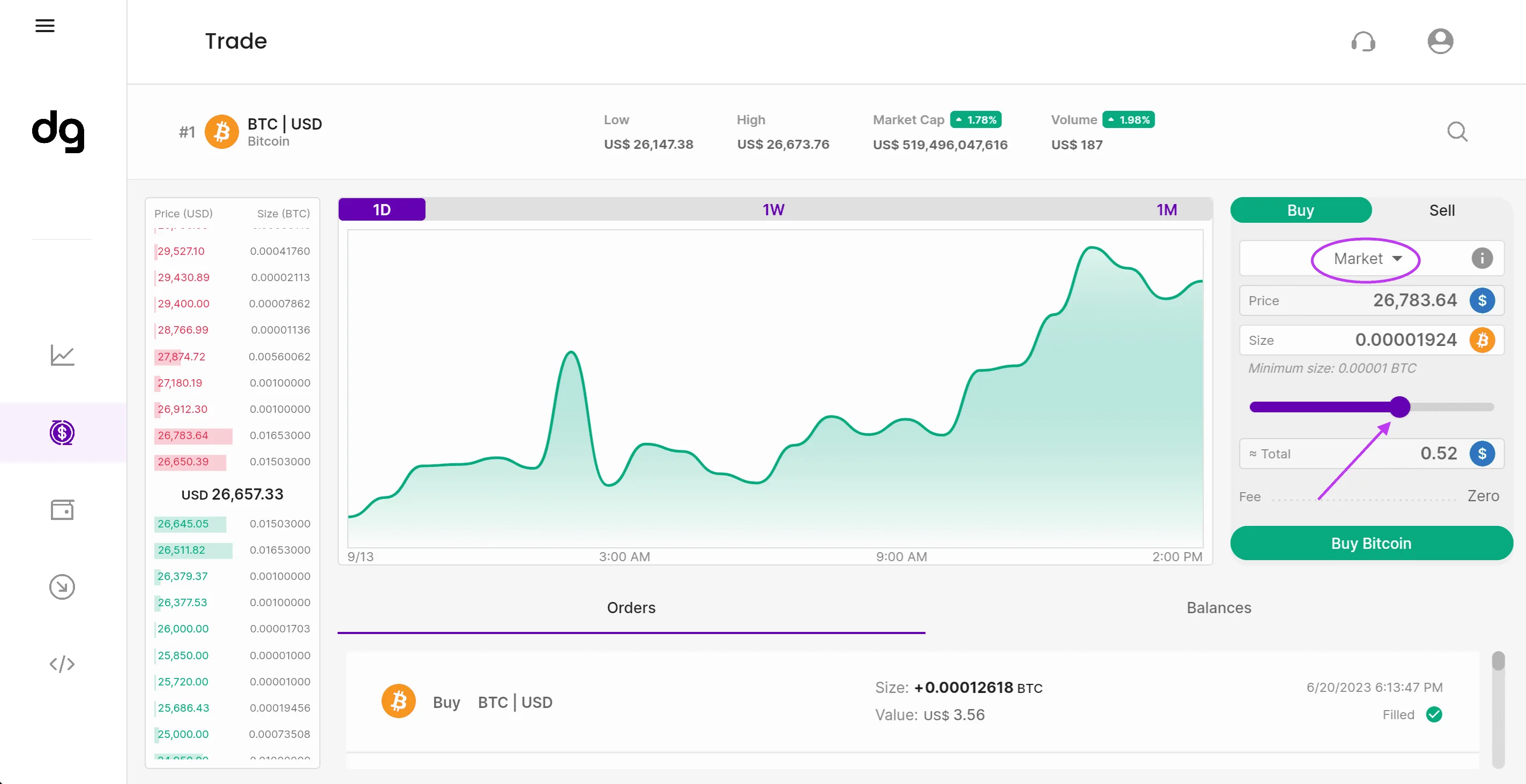

Fast Trade on digitra.com

Digitra.com offers a fast exchange type with a simpler and easier tool for executing orders. In this case, orders are executed at the market price, so when you use the Fast Trade tool, remember that the order will be executed at the market price, based on the features we talked about earlier.

The difference between the Fast Trade feature and Market Trade on digitra.com is that the former only allows you to select the amount to be bought or sold by the available percentage in your wallet. For example, if you want to buy Bitcoin using your balance in dollars, you can choose from 25%, 50%, 75%, and 100% of your dollar balance.

In the "Trade" section, on the other hand, you can use the slider, giving you more options for the amount you want to trade.

The decision is yours

The choice between a limit order and a market order depends on your individual needs and preferences. If you're looking to execute a trade quickly and don't mind the price, a market order may be the best option. If you want more control over the price at which you buy or sell your cryptocurrency, a limit order may be the better choice.

Keep reading DGFresh if you want to learn more about cryptocurrency trading and investing!