DGTA Token: Monthly Buyback and Burn

Understand digitra.com's utility token buyback and burn plan.

Starting June 2024, part of the DGTA token supply, digitra.com's own cryptocurrency, will be burned monthly by the exchange. The burn plan includes tokens repurchased and units from fees paid by platform clients. Over the next four months, four million DGTA tokens will be burned, one million each month. Understand how the buyback and burning strategy works, well-known in the crypto world, and what motivates digitra.com to reduce the supply of DGTA in the market.

What is the DGTA token?

The DGTA token is digitra.com's own ERC-20 cryptocurrency, created to support key platform benefits and drive client adoption, especially among early users.

You can read the token Litepaper here!

Trade to Earn

With DGTA, digitra.com pioneered the Trade to Earn program, rewarding clients for buying and selling coins on its platform. The model is based on game and learning programs like Play to Earn, Move to Earn, and Learn to Earn.

According to the token's Litepaper, Digitra.com distributes 15,000 DGTA daily among all order books available on the platform. Each order book airdrop individually it's tokens among its clients. The distribution among clients is divided as follows: 25% shared equally among all traders, and 75% distributed proportionally to the trading volume. This way, everyone gets a share of the total distributed, while the exchange benefits frequent clients.

Referral Program

In addition to Trade to Earn, the DGTA token is also the reward currency for digitra.com's Referral Program. 5,000 DGTA tokens are distributed each day for the Referral Program, 4,000 among the referrals and 1,000 among the referrers. Learn more about the Referral Program here!

How does token burning work?

Token burning is a process in the cryptocurrency world where a certain amount of tokens is permanently removed from circulation. This is done by sending the tokens to a specific, inaccessible wallet address, often called a "burn address" or "black hole address," where they cannot be recovered or spent.

The primary goal of token burning is to reduce the total supply of a cryptocurrency, potentially increasing its value over time due to the resulting scarcity. This practice is often used by cryptocurrency projects as a strategy to control inflation, reward token holders, and encourage the sustainability and appreciation of the digital asset.

How does token buyback work?

Token buyback is a process where the issuing entity of a cryptocurrency buys back its own tokens from the open market. This mechanism is similar to stock buybacks in traditional companies and can have various objectives, such as increasing the demand and value of the remaining tokens, distributing tokens more efficiently among holders, or adjusting them according to the project's long-term strategy.

During a buyback, the entity uses reserve funds or profits to purchase the tokens, which can then be held in treasury, burned (to reduce the total supply), or redistributed through incentive programs. This process signals confidence in the future appreciation of the cryptocurrency and can strengthen the perception of value among investors.

For the DGTA token, the repurchased units will be burned. Below, you will find more details about this!

How will DGTA token buyback and burning work?

The DGTA token burn is planned to occur monthly, starting in June 2024, when digitra.com will burn 1 million tokens. This total includes tokens repurchased (buyback) by the exchange and fees paid in DGTA by clients trading on the platform. According to the token's whitepaper, digitra.com intends to burn 50% of the total token supply, achieving this by burning tokens monthly.

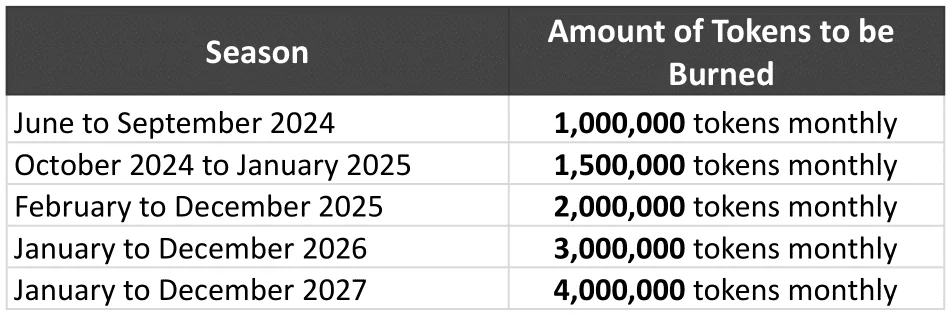

Here's how it works: In the first four months of burning, the monthly amount of tokens burned will be 1 million, totaling 4 million. From October 2024, the monthly burn amount will be 1.5 million DGTA tokens and will continue until January 2025. Starting in February 2025, the monthly burn amount will be 2 million tokens, continuing until December of the same year. After that, the monthly burn volume will only increase annually, rising to 3 million in 2026, 4 million in 2027, and so on. Thus, the DGTA burning will continue to increase until reaching the total burn goal (50% of the supply).

See the table below for details:

Is it worth investing in the DGTA token?

To determine whether it is worth investing in the DGTA token, you need to understand how utility tokens work. Generally, this type of cryptocurrency is developed to generate value for the clients of a specific platform or company. The utility of these tokens is often linked to exclusive benefits and access for their holders.

Moreover, investing in this type of token can be related to the client's confidence in that platform, as the value of a utility token tends to increase as its issuing company grows. However, like any other cryptocurrency, utility tokens are a high-risk investment and can bring significant gains or losses to investors.

Before investing in a utility token like DGTA, it is worth delving into the topic by reading this article on exchange tokens and this article on how the cryptocurrency market works.

Remember, the issuing company is not responsible for any losses, and the investor is aware of the risks of investing in volatile assets.

If you are looking for more information on cryptocurrency investments, keep reading DGFresh!